Learn Some Important Facts If You Are Considering Chapter 7 Bankruptcy

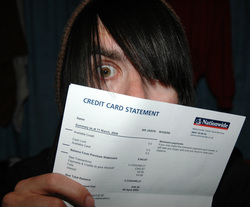

If you read chapter 7 bankruptcy information you will learn that this form of bankruptcy is often called a "straight bankruptcy" or "liquidation" and is a common form of debt relief for U.S citizens that are no longer able to meet their financial commitments.

Chapter 7 bankruptcy information will teach you how this form of bankruptcy can help you clear your debt through the sale of non-exempt property to raise money to go towards clearing your outstanding balances. This is where you turn over all non-exempt property to a court-appointed trustee. It is the trustees job then to sell the assets to raise money to pay back as much as possible to your creditors.

Chapter 7 bankruptcy information will teach you how this form of bankruptcy can help you clear your debt through the sale of non-exempt property to raise money to go towards clearing your outstanding balances. This is where you turn over all non-exempt property to a court-appointed trustee. It is the trustees job then to sell the assets to raise money to pay back as much as possible to your creditors.

Chapter 7 bankruptcy information also states that there are exemptions that are designed to protect your property from a creditor sale if you file Chapter Seven. Knowing how these exemptions work could help you protect yourself today while helping you get a fresh start tomorrow. For each state, exemptions are different. You don't always lose all your assets and possessions as the impression this article might give. You definitely want to choose an experienced firm to help you as much as possible.

Chapter 7 Bankruptcy Information - Filing For Bankruptcy

By reading Chapter 7 bankruptcy information on the actual filing, you will learn that it can be a complicated process with many items that should be taken into consideration including, among other things, the Chapter 7 bankruptcy means test. It is recommended that you obtain the advice of a bankruptcy attorney before you begin the bankruptcy filing process.

Once an individual decides to file a petition that they be granted bankruptcy status, they will need to complete the extensive paperwork. You are able to download the official bankruptcy forms online but just remember that bankruptcy forms vary by state. While these forms are electronic in nature and reside on a computer, You still have to complete the bankruptcy forms in full as you do with standard paper forms and you are still left to try to deal with the complex laws of bankruptcy.

Once an individual decides to file a petition that they be granted bankruptcy status, they will need to complete the extensive paperwork. You are able to download the official bankruptcy forms online but just remember that bankruptcy forms vary by state. While these forms are electronic in nature and reside on a computer, You still have to complete the bankruptcy forms in full as you do with standard paper forms and you are still left to try to deal with the complex laws of bankruptcy.

My advice, after reading Chapter 7 bankruptcy information, would be to contact a reputable bankruptcy attorney to seek their advice. This is a complex area of law and you need someone who specializes in bankruptcy to help.

Chapter 7 Bankruptcy Information - Hiring A Bankruptcy Attorney

A bankruptcy lawyer can advise you on the best time to file and help you though all the pitfalls and also whether any other chapter bankruptcy may be more suitable.

A good bankruptcy attorney will ensure that all requirements are catered for so that the bankruptcy will go as smoothly and stress free as possible. They will also be able to advise as to whether your assets will be safe if you file and may be able to help you keep more of your hard earned assets.

To learn more about chapter 7 bankruptcy rules and other forms of debt relief just click the link.